Table Of Content

Look at your full financial picture after you’ve tracked your income and expenses for a few months. For example, if you realize you have $3,000 left over at the end of each month, decide how much of that could be allocated toward a mortgage. Apply online for expert recommendations with real interest rates and payments. If you have $25,000 saved up, that would be enough for the minimum 5% down payment on a home worth $500,000 or less. If you’ve saved less than that, you’ll only be able to put 5% down on a home worth less than $500,000.

Get pre-approved and secure your dream home

'I shouldn't be punished': My sister can't afford to buy me out of our mother's $450,000 house. She has no home. What ... - Yahoo Finance

'I shouldn't be punished': My sister can't afford to buy me out of our mother's $450,000 house. She has no home. What ....

Posted: Sat, 10 Feb 2024 08:00:00 GMT [source]

APR (%) is a number designed to help you evaluate the total cost of a mortgage. The APR is calculated according to federal requirements and is required by law to be stated in all home mortgage estimates. This allows you to better compare how much mortgage you can afford from different lenders and to see which is the right one for you. But it isn’t only in your lender’s interest to keep this rule in mind when looking for a house - it’s in your's too. Since lenders tend to charge higher interest rates to borrowers who break the 36% rule, you’ll probably end up spending more on interest if you go for a house that places you beyond that limit. Plus, you may have trouble maintaining your other financial obligations, including building up your emergency fund and saving for retirement.

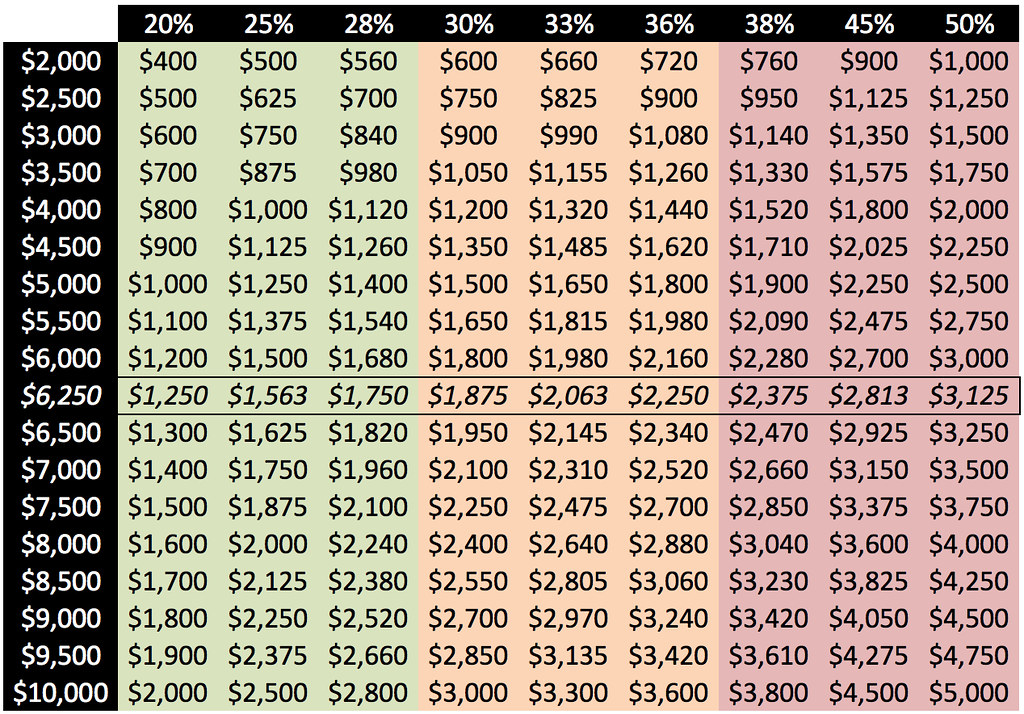

Percentage of income toward monthly payment

Your lender will use two debt ratios when determining whether you can afford a mortgage. These ratios are called the Gross Debt Service (GDS) ratio and Total Debt Service (TDS) ratio. They take into account your income, monthly housing costs and overall debt load.

Why You Should (and Shouldn't) Sell Your Home in 2024 - Real Estate

Why You Should (and Shouldn't) Sell Your Home in 2024.

Posted: Thu, 04 Apr 2024 07:00:00 GMT [source]

How does the type of home loan impact affordability?

The unifying factor between either model is the fact that you’ll need the money to put up to sign on your mortgage and walk away with a keyset. Here's how to figure out what you can afford and what eligibility requirements you need to qualify for an FHA loan. Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand.

A bi-weekly mortgage is a mortgage in which the borrower makes half of their monthly mortgage payment every two weeks, rather than paying the full payment amount once every month. So if you paid monthly and your monthly mortgage payment was $1,000, then for a year you would make 12 payments of $1,000 each, for a total of $12,000. But with a bi-weekly mortgage, you would make 26 payments of $500 each, for a total of $13,000 for the year. This can help the borrower pay off their mortgage loan sooner and reduces the total amount of interest paid over the life of the loan.). Homeowner's insurance is based on the home price, and is expressed as an annual premium.

Common questions about mortgage affordability

Canada’s minimum down payment guidelines have a large say in how much you’ll be allowed to borrow. You’ll pay less in interest, and if the market goes sideways or some other event causes you to sell earlier than you anticipated, you’ll have more equity to lean on. Even if all those indicators are flashing green, saving up a larger down payment will make you look like even less of a risk. Lenders may see you as someone who establishes financial priorities and understands how to save. Lenders need to see evidence that your income is both stable and sufficient enough to cover the cost of a mortgage. You can show proof of income using a letter of employment from your company and recent paystubs.

Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years. Under "Home price," enter the price (if you're buying) or the current value (if you're refinancing). Now that you have your estimated home price, check out different loan options with our Mortgage Calculator. You’ll often hear that you should have three to six months’ worth of living expenses saved to cover emergencies. As a homeowner, you’d be wise to have six months to two years’ worth of living expenses saved. You never know when a global pandemic might wreak havoc on your ability to earn a living and pay for your home.

This does not include expenses such as homeowners insurance, property taxes or HOA fees. The first number in the 29/41 rule, 29, represents your housing expense ratio. So, let’s say this couple takes out a 30-year, fixed-rate mortgage at 7% for a $700,000 house, and makes a down payment of $140,000.

Conventional Loans and the 28/36 Rule

Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans. The rising cost of homeownership means sellers and buyers should enter today's market with lowered expectations, said Redfin economic research lead Chen Zhao. Americans are expected to buy 4.46 million existing homes this year, a 9% increase from 2023.

The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan. There is something to be said for the idea of not maxing out your credit possibilities. If you look at houses that are priced somewhere below your maximum, you leave yourself some options. For one, you will have room to bid if you end up competing with another buyer for the house.

If you’re planning to buy a house, you’ll need to get a sense of how much home you can afford. Programs, rates, terms and conditions are subject to change without notice. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

The elevated costs add to the challenges facing homebuyers amid the spring home-buying season. Real estate activity tends to pick up in the spring, as homeowners traditionally list their properties during the season and buyers venture to open houses amid warmer weather and longer days. Simultaneously to the swift pivot in mortgage rates, home values have been spiking.

A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content.

The rule of thumb is to meet with at least three lenders to compare mortgage rates but five is often preferred. The more quotes you get, the greater possibility that you can save thousands of dollars over the life of your loan. A key factor in whether or not you can afford a home is based on the mortgage rate offered. And with current mortgage rates doubling in 2022, it has been a top factor in slowing down home purchases heading into 2023. Even a few basis points can make the difference between a home being affordable or out of reach (a basis point equals one-hundredth of a percentage point). So don’t feel like you’re stuck with the rate of the first lender you meet.

Read more on specialized loans, such as VA loan requirements and FHA loan qualification. In addition, take a look at the best places to get a mortgage in the U.S. You can also check out current mortgage rates in your area for an idea of what the market looks like. You’ll stop paying PMI when your mortgage reaches about 78% of the home’s value.

No comments:

Post a Comment